Google Sheet Mortgage Calculator

Google sheets is the jack of all trades of the spreadsheet world. It’s free, flexible, and widely supported with plugins…and best of all TEMPLATES. And it’s those templates that we’re going to get into here because whether your a loan officer, real estate agent or a extra analytical home buyer, Google Sheets has a variety of calculators that can simplify the often overwhelming topics surrounding of home finance.

And these calculators aren’t created by Google btw. They’re created by other users and then made public for anyone to use. There’s a LONG list of public Google Sheets which have been customized into easy-to-use forms that can help with almost any data dependent decision.

…and when it comes to mortgage, we sifted through thousands, did the research, and picked out a few that can be trusted for the most common situations that real estate professional come across. Here are our favorites along with some other tips and tools to make the most of making mortgage calculations with Google Sheets:

- Best Practices when using a Google Sheet Mortgage Calculator

- Standard Mortgage Calculator

- Mortgage Down Payment and Affordability Calculator

- Loan Amortization Calculator

- Home Cost Calculator

- Refinance Comparison Calculator

- Cash Out Refinance Mortgage Calculator

- Home Equity Calculator

- Debt-to-Income Ratio Calculator

- Rent vs Buy Investment Calculator

- Making your own Google Sheet Mortgage Calculator

Best Practices when using a Google Sheet as a Mortgage Calculator

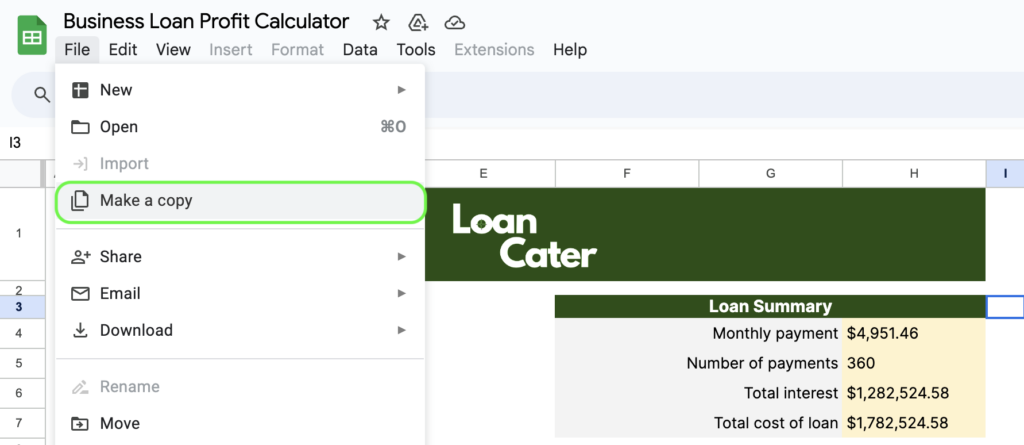

Before using any of the calculator templates below, you’ll need to know how to copy these “view only” templates so you can use the Google Sheet within your own account. Luckily it’s just a couple clicks: In the “File” menu, select “Make a copy” and you’ll be all set.

Also a few other tips when using these calculator templates:

- If you’re sharing these with clients and associates you’ll want to make a new copy for every calculation so people’s information isn’t accidentally shared and you don’t get multiple parties editing the same document, overwriting each others info.

- When sharing these, avoid making them “public” because you don’t want to accidentally publicize sensitive info to the internet.

- To avoid unwanted document edits, when you share the document, you can set recipients as “Viewers” or “Commenters” to further avoid any unwanted edits.

- Setting recipients as “Commenters” can be helpful to collect and respond to feedback right within the document.

Now let’s get into all the the Google Sheet Mortgage Calculators and Finance Templates…

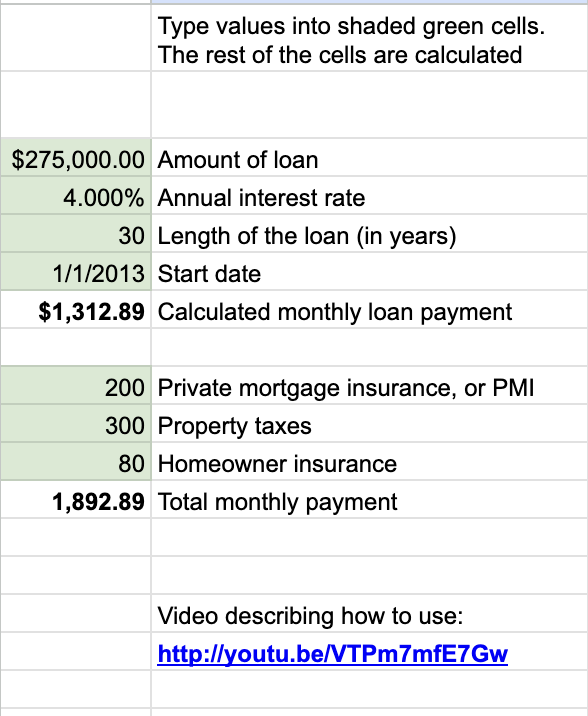

Standard Mortgage Calculator

Best to start with the basics right?

The Best Mortgage Calculator calculates the top line number most people care about…the monthly payment. This calculator also includes an amortization schedule.

If needed, here’s a video that gets into how to use this calculator (but this one is as basic as it gets).

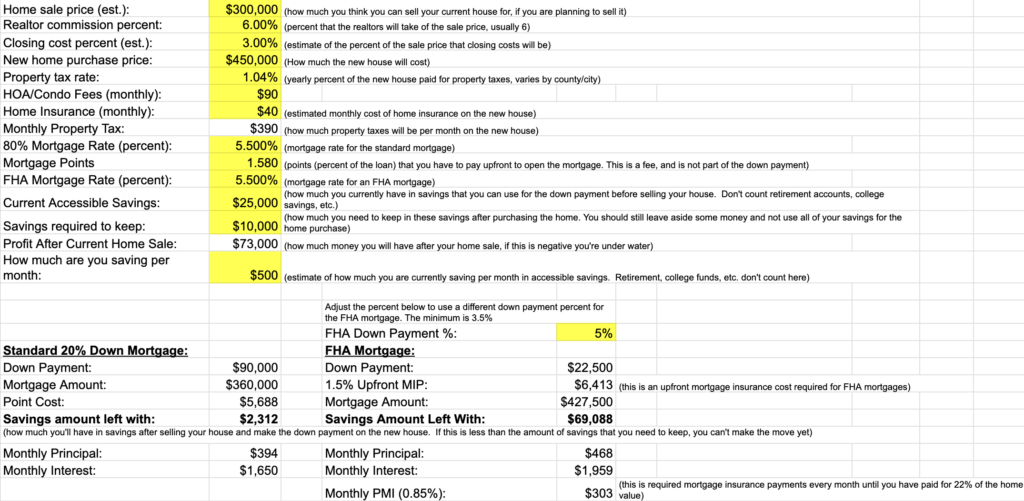

Mortgage Down Payment and Affordability Calculator

For every potential homeowner, understanding the financial parameters before plunging into house hunting is an indispensable step.

Mortgage, Down Payment, and Affordability Calculator

Usage Note on using this Google Sheet: Once you’ve made a copy of this (File Menu > “Make A Copy”) edit values in the yellow cells, Do NOT modify values in any other cell, these will be computed once you enter values in the yellow cells.

You’ll notice that this calculator includes values for for your income and amount owed on an existing home which makes it more comprehensive than standard off-the-shelf “mortgage calculators”.

By utilizing a well rounded tool like this, you’re giving your clients (or yourself) a running start towards a more informed homeownership decision.

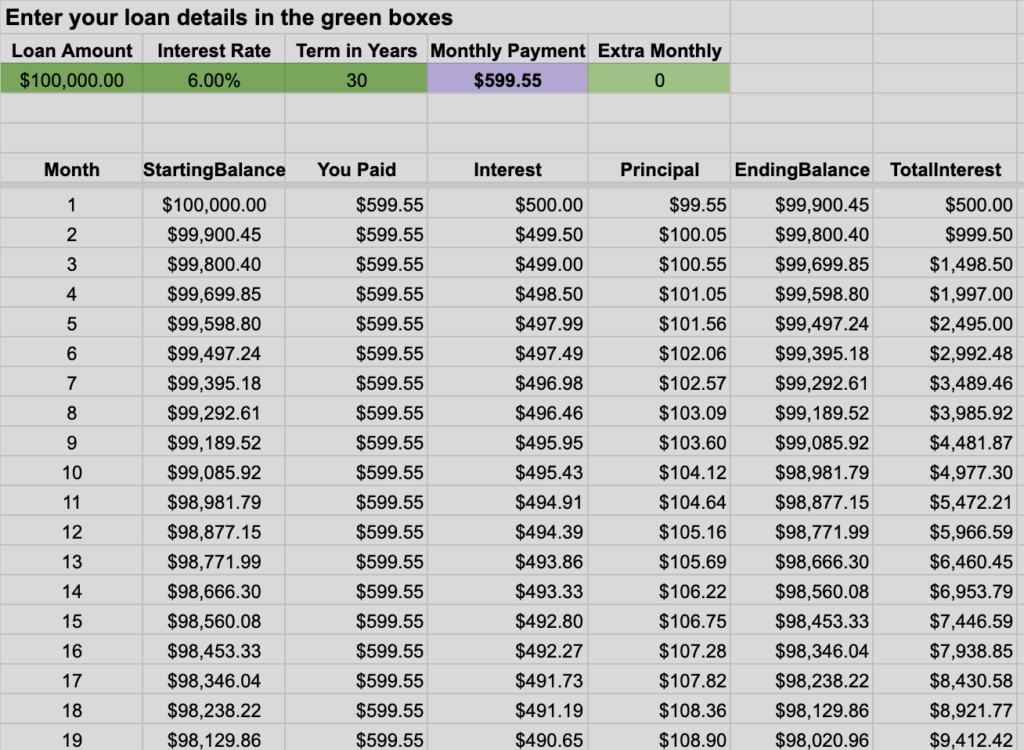

Loan Amortization Calculator

The Loan Amortization Calculator unpacks each of your loan repayments – breaking down how much of your monthly payment is allocated towards the principal and the interest.

Here’s a video that gets into how to use this calculator (but again these are pretty self explanatory).

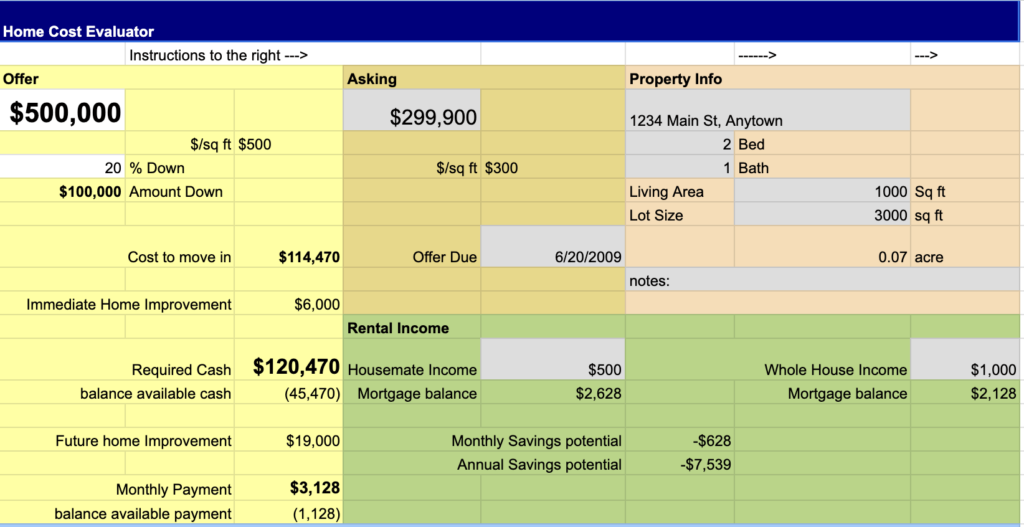

Home Cost Calculator

Want to get all the homeownership costs in front of you? The Home Cost Calculator provides a detailed overview of all the expenses involved in owning a home. When you’re armed with this Home Cost Calculator, you’ll avoid hidden costs can lead to last minute stress that can risk the entire purchase as well as regret that occurs after the purchase.

Some instructions when using this calculator:

- Only change those cells which are white or gray in the spreadsheet.

- Recommendation is to copying the tab for each property you want to evaluate.

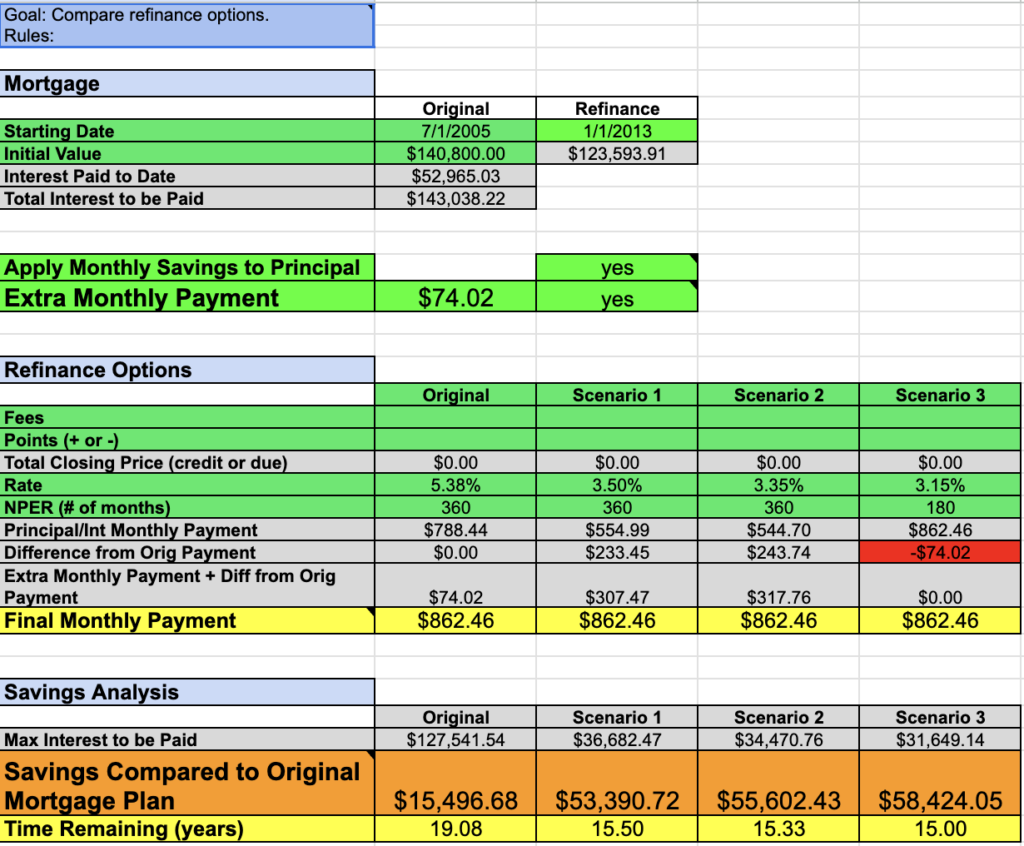

Refinance Comparison Calculator

The Google Sheet was probably never better suited for use-case than a refinance calculator. That’s because the decision on whether or not to refinance is cut and dry math. The Refinance Comparison Calculator allows you to compare different refinance scenarios to pick the best option.

Armed with details of your existing loan and potential refinancing options – such as interest rates, term lengths, and closing costs – you can confidently understand for the most cost-effective solution.

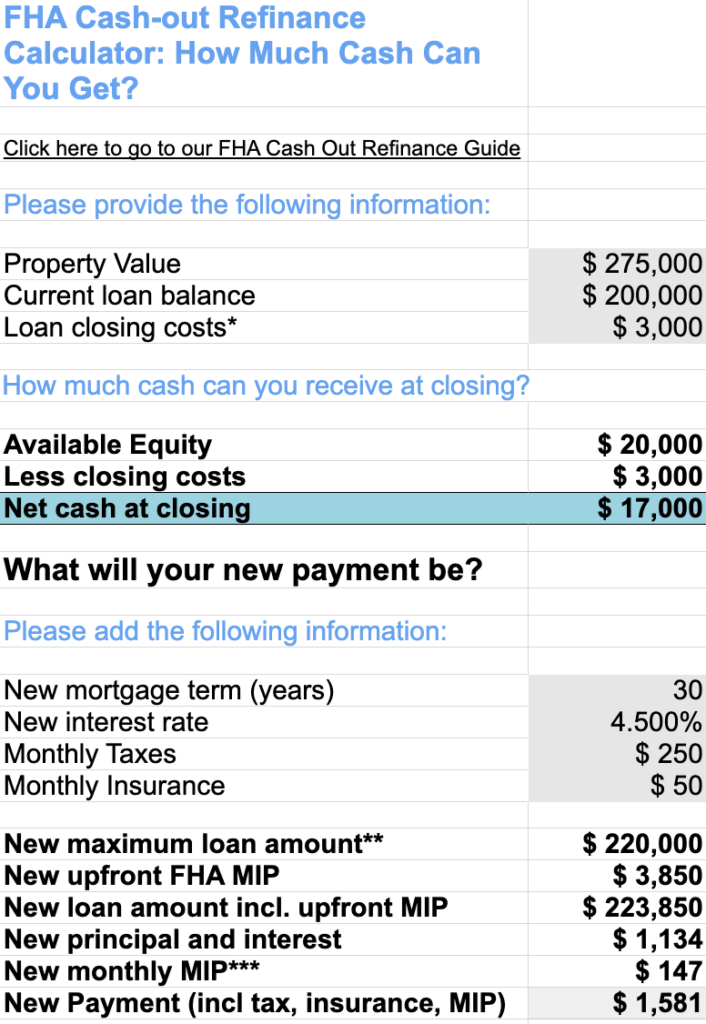

Cash Out Refinance Mortgage Calculator

The FHA cash-out refinance allows homeowners to access the cash value of their home’s equity by refinancing their current mortgage with a larger one. Before making this decision it’s best to understand the whole picture including closing costs. The Cash-Out Refinance Mortgage Calculator does just that.

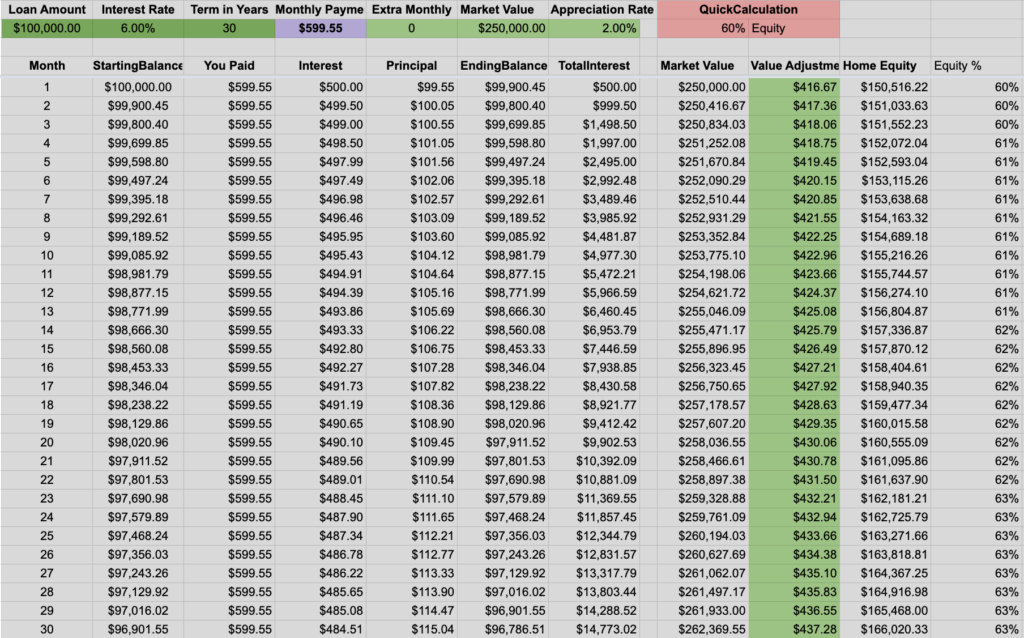

Home Equity Calculator

We covered the amortization schedule calculator above but this Google Sheet calculator takes it to another level. With the Home Equity Calculator takes that schedule, let’s you estimate annual appreciation, and then shows how much equity you’ll have at any point in time.

To immediately create a copy of this mortgage calculator in your own Google Sheets account, click here.

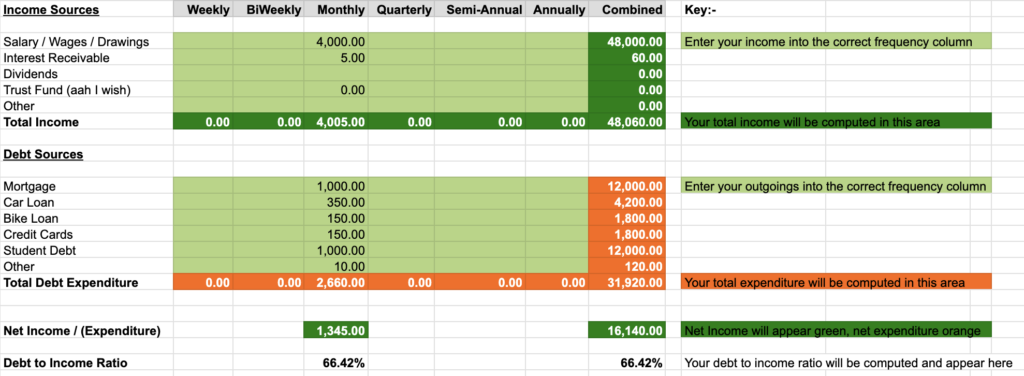

Debt to Income Ratio Calculator

This is one of the key ratios that loan officers use to understand whether someone can qualify for a mortgage. Essentially, this is the proportion of your income you’ll need to service your mortgage debt each month. And this Debt to Income Ratio Calculator makes it really easy.

The spreadsheet does a great job at simplifying the variables needed too – just refer to the info on the far right column.

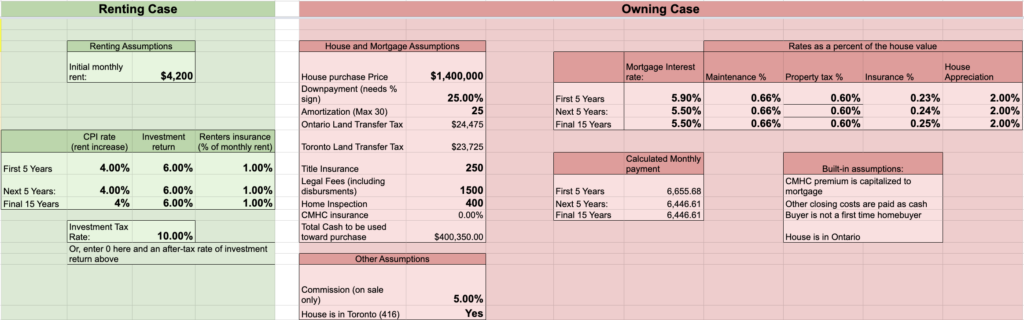

Rent vs Buy Investment Calculator

As anyone in real estate knows, terms like “affordability” and “rent vs buying” are commonly mentioned alongside national stats…but the rent vs buy calculation is unique to everyone’s situation…and that’s why this calculator can be an invaluable financial tool.

This Rent vs Buy Investment Calculator makes this crucial financial decision easy to understand in the current moment AND across different time horizons.

Making your own Google Sheet Mortgage Calculator

As you’ve seen above, on Google Sheets there are a lot of possibilities…including creating your own mortgage calculators.

Don’t be intimidated by the blank spreadsheet staring back at you when you create a new sheet. This YouTube video shows how to create a mortgage calculator from scratch.

And if you want to wing it, Google Sheets has a PMT function which calculates interest rate based payments.

Are you ready to become a full fledged spreadsheet jockey? Well if not, are you at least more comfortable with the utility of Google Sheets based mortgage calculators? Hope so, because these templates can empower you and your clients to visualize financial goals using data driven, visual solutions. Now get your PMT on!