Seller Net Sheets

Seller net sheets are a critical part of selling a property. These documents show sellers their net proceeds, and factor in various amounts like real estate agent commissions, closing costs, and mortgage balances and more (as we’ll explore in detail below).

Typically, seller net sheets are shared by a listing agent multiple times during the course of the sale process. Many listing agents will prepare net sheets for their sellers when evaluating different offers…and they get revised as figures change during the process.

Think of seller net sheets as the less formal cousin of the seller closing statements (a key part of the closing disclosure). We’ll dive into a few topics below that agents must know when navigating the process of creating and delivering a sellers net sheet:

- Why is a Seller’s Net Sheet Important

- What’s on a Seller’s Net Sheet

- How to Prepare and Explain a Sellers Net Sheet (video included)

- Seller Net Sheet FAQs

Why is a Seller’s Net Sheet Important?

Similar to Jerry Maguire yelling “SHOW ME THE MONEY” to demonstrate his commitment to bringing value to his client, seller net sheets “show sellers the money” that they’ll actually net after the sale of their property. Which can be drastically different than the amount on the accepted offer.

Selling a property can result in the largest financial gain of a person’s life. And for many sellers, it’s easy to let their imagination excitedly start spending the sale proceeds. That’s why this document is critical to manage expectations.

It’s Not What You Make, It’s What You Keep

Julian Block

A sellers net sheet is also a living document that can change as taxes, HOA dues, mortgage interest etc change over time. That’s why the listing agent will often revise the seller net sheet multiple times throughout the process.

That’s the paramount importance of seller net sheets, magnifying the crucial role they play in the real estate sector.

What’s on a Seller’s Net Sheet

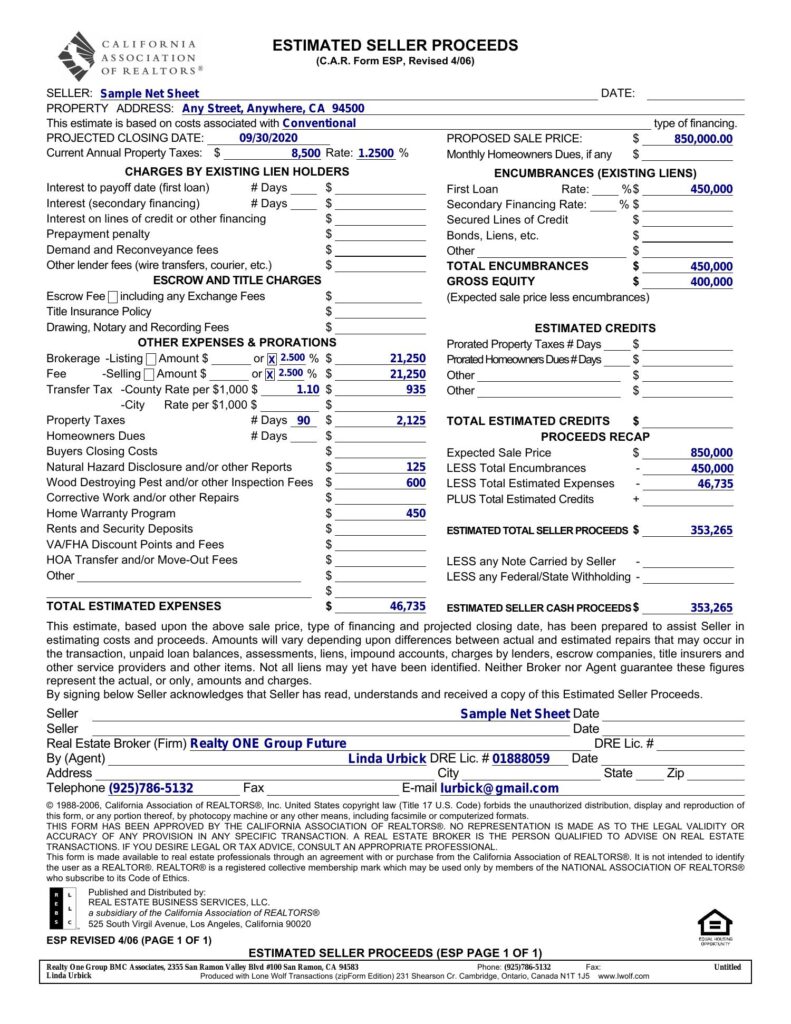

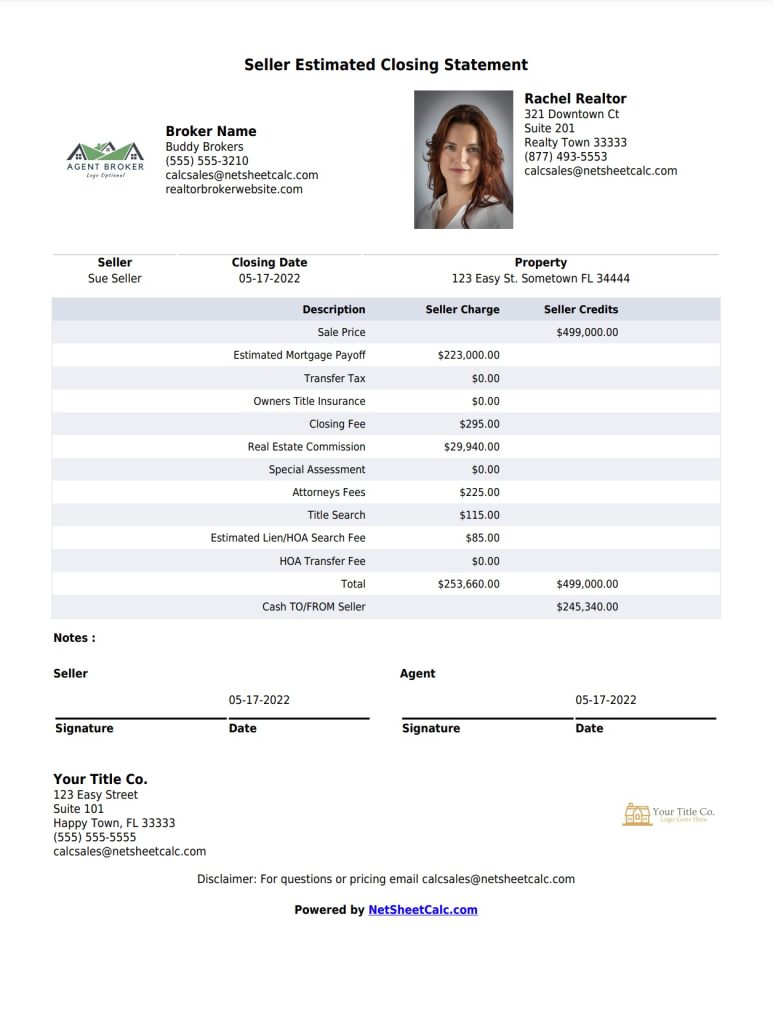

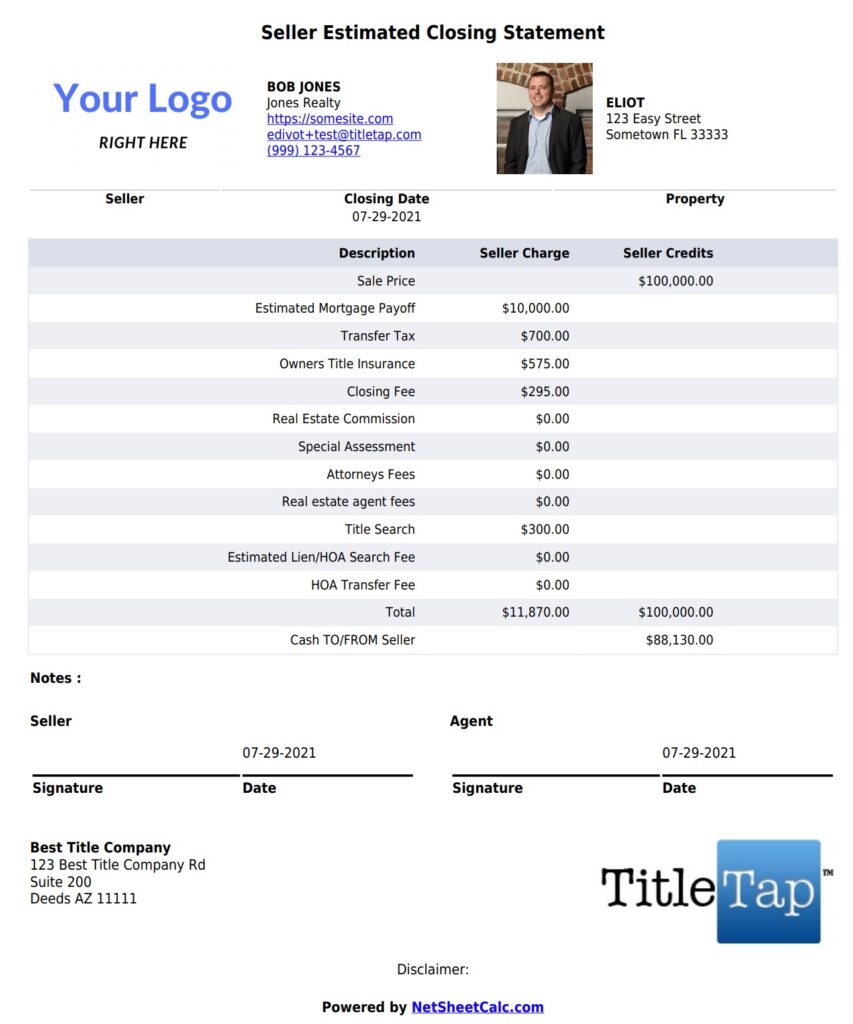

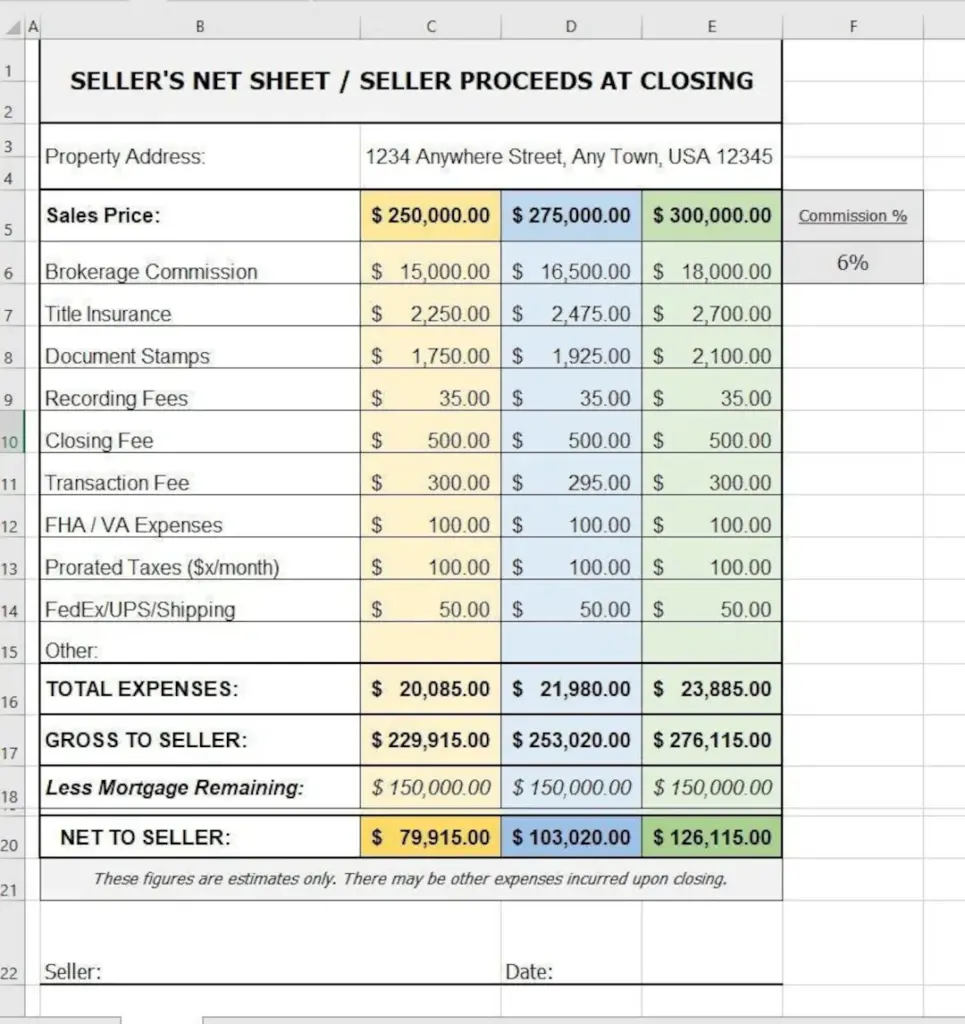

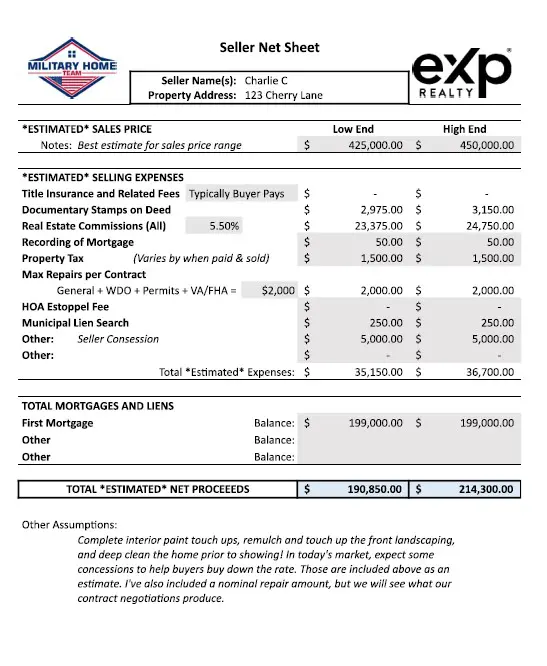

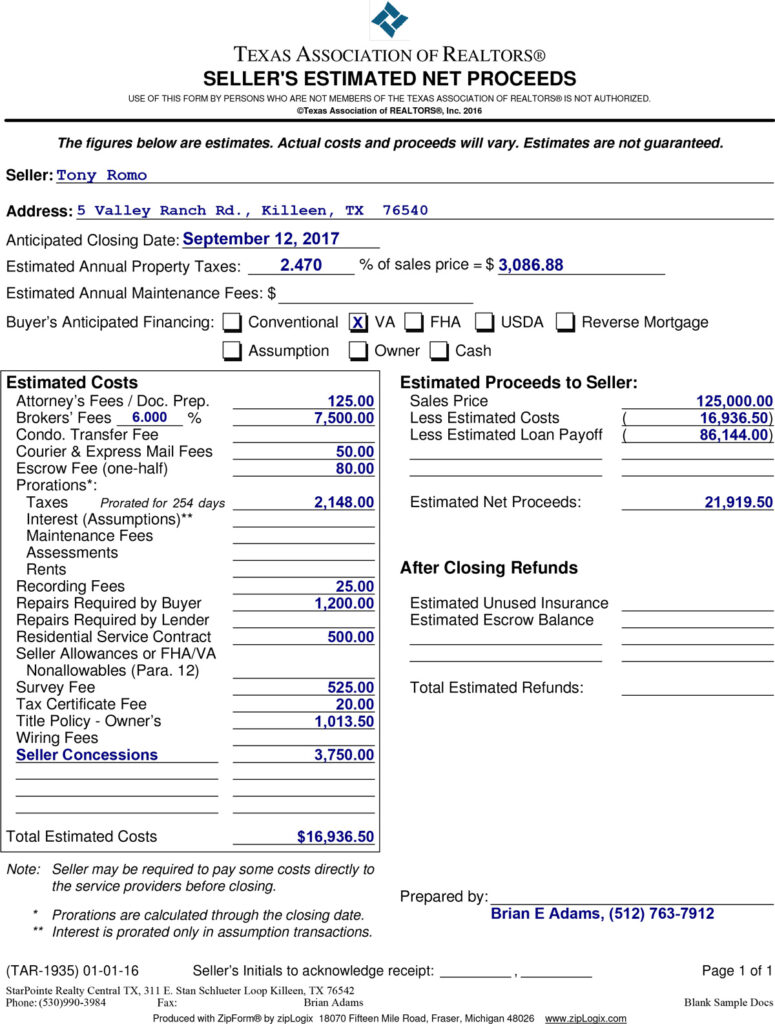

Continuing our discussion on seller net sheets, let’s delve further into what these documents entail. A seller’s net sheet needs to be a comprehensive calculation for sellers. Here’s a few examples in different formats.

Notice that these examples have common line items included in the net sheet:

1. Sale Price: This is the starting point of the net sheet, representing the potential income from the sale. A detailed net sheet might show a range for the sale price, allowing sellers to understand how varying sale prices impact their net proceeds.

2. Real Estate Agent Commission: This is a significant expense, usually a percentage of the sale price, paid by the seller for both the buyer’s and seller’s agents. The commission rate can vary based on the agency, agent experience, and property type, and it directly affects the seller’s net proceeds.

3. Closing Costs: These are varied fees and charges incurred at the end of the real estate transaction, including attorney fees, escrow fees, title fees, and title insurance. Sellers need to account for their portion of these costs, which can be a subject of negotiation.

4. Mortgage Balance: The outstanding mortgage balance at the time of sale must be paid off from the sale proceeds. Including this figure in the net sheet is crucial for accurately estimating the net proceeds.

5. Property Taxes: Sellers are responsible for property taxes up until the closing date, calculated on a prorated basis. Given the potential variance in local tax rates, this expense is important for an accurate net sheet.

6. Deed Stamps/Transfer Taxes and Recording Fees: These are taxes paid by the seller related to the transfer and recording of the property deed. The cost depends on the sale price and local tax rates, representing a part of the transaction costs.

7. Repairs: If repairs are requested following inspections or appraisals, their costs need inclusion in the net sheet. This could range from minor fixes to significant updates like roof replacements, influencing the final net proceeds.

8. Home Warranties and Other Seller Concessions: Offers like home warranties can make a property more attractive but also affect the seller’s net proceeds. Any such concessions should be factored into the net sheet to provide a realistic view of the financial outcome.

Important to note on these line ite,s:

- Some of the costs on the sellers net sheet are estimated, but as more information becomes certain (ex: closing date) the estimated costs will become actual…helping sellers develop a better understanding of the total financial equation throughout the process

- The seller’s net sheet, covers both recurring and non-recurring closing costs. The recurring costs include items such as property taxes and home insurance, while the non-recurring costs include one-time fees such as escrow, title policies, home inspection, and natural hazard disclosure reports.

How to Prepare a Sellers Net Sheet

There are a variety of tools and approaches for agents to prepare sellers net sheets. We’ll include a few popular options in each category:

- Title Companies: many title companies will help produce seller net sheets for agents and have calculators on their website to assist agents in creating their own seller net sheets. Here are a couple examples (some are region specific):

- RPR: NAR members can use RPR to prepare a seller net sheet – more info on how this feature works here

- MLS: Some MLS platforms include a seller net sheet feature

You can also do it yourself on a spreadsheet using a process detailed here:

Seller Net Sheets FAQs

- Who prepares the seller’s net sheet?

The listing agent typically prepares the seller’s net sheet, using tools such as Excel spreadsheets, real estate software, online forms, or calculators. This document, which can be provided in various formats including print and digital, is designed to give sellers an accurate expectation of their potential profits. Title escrow officers and title companies may also offer this information, with some providing online calculators for a rough estimate. - As a home seller, when do I receive a seller’s net sheet?

Home sellers usually receive the seller’s net sheet from their listing agent before the home is listed to help set the appropriate list price. Agents are advised to update and provide net sheets at various stages, such as when setting the list price, receiving offers, and during negotiations to reflect updated figures. This ensures sellers can make informed decisions based on the most current financial outlook. - Is an agent required to supply a seller’s net sheet?

While highly beneficial, there is no mandatory requirement for real estate agents to provide a seller’s net sheet. However, sellers, especially those who are selling for the first time or those whose mortgage balance is close to the sale price, are encouraged to request one. A seller’s net sheet helps in understanding all potential expenses and profits, ensuring there are no surprises regarding the financial aspects of the sale.

In conclusion, the seller’s net sheet stands as an invaluable tool for those embarking on the journey of selling their property. By providing a detailed forecast of the potential expenses and profits associated with the sale, it empowers sellers with the knowledge needed to make informed decisions throughout the transaction process. From setting the initial list price to evaluating offers and finalizing the sale, the insights offered by the net sheet can significantly influence a seller’s strategy and expectations.

Given its importance, sellers are encouraged to work closely with their listing agents to ensure that a comprehensive and up-to-date net sheet is part of their selling toolkit. While not mandated, the proactive request of such a document can prevent surprises and align financial expectations with reality, especially for those new to the real estate market or with tight margins between their mortgage balance and sale price. Ultimately, the seller’s net sheet demystifies the financial complexities of selling a home, guiding sellers to a successful and satisfying conclusion.